Massive Merchant Network Unlocked by Scan to Pay and Partners

SW

BY SARAH WHITE

Verified Contributor

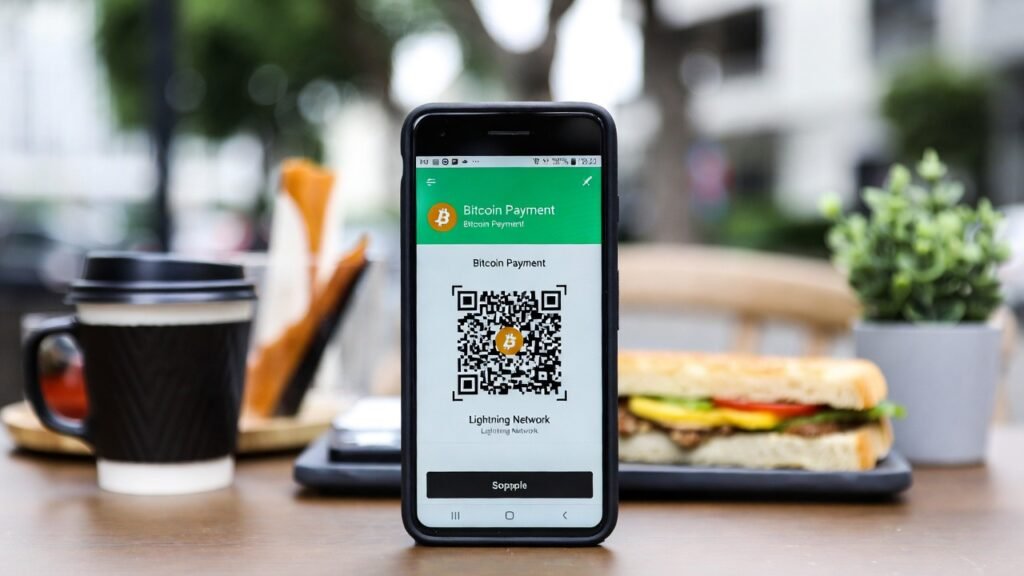

South Africa Leads Africa’s Bitcoin Revolution: Lightning Network Powers Everyday Payments at Over 650,000 MerchantsSouth Africa has solidified its position as a global hotspot for real-world Bitcoin adoption, transforming the cryptocurrency from a speculative asset into a practical tool for daily transactions. Through innovative integrations like the Lightning Network—Bitcoin’s layer-2 scaling solution for instant, low-cost payments—millions of South Africans can now spend BTC at everyday retailers, from supermarkets to local shops.

Massive Merchant Network Unlocked by Scan to Pay and Partners

In October 2025, a groundbreaking partnership between Bitcoin payments provider MoneyBadger and QR-based processor Scan to Pay enabled seamless Bitcoin (and stablecoin) payments across over 650,000 merchant locations nationwide. This integration leverages the Lightning Network to deliver near-instant settlements with fees often under a fraction of a rand—far faster and cheaper than traditional card or bank transfers. Major chains like Shoprite, Checkers, Makro, Vodacom, and others are now accessible via this network, connecting users from exchanges such as Luno, Binance, VALR, and Blink.

Reports from late 2025 and early 2026 indicate the figure has climbed toward 700,000 potential outlets as more gateways (including Ozow + MoneyBadger collaborations) embed crypto rails into existing POS systems.

Small businesses display “Bitcoin preferred” stickers, while larger franchises settle in rand but accept sats at checkout. Communities in places like Ekasi and Witsand have seen local shops embrace BTC, keeping value circulating within neighborhoods via peer-to-peer trust networks. National players like Pick n Pay (with over 2,200 stores) have rolled out similar capabilities, allowing customers to pay for groceries, airtime, electricity, and bills directly from Bitcoin wallets. The result? Bitcoin is no longer just held, it’s spent on coffee, fuel, and essentials, “state-proofing” users against volatility and enabling financial resilience in a high-inflation environment.

Broader Sub-Saharan Momentum: $205 Billion in On-Chain Value

South Africa’s merchant surge is part of a larger continental story. According to Chainalysis’ 2025 Geography of Cryptocurrency Report, Sub-Saharan Africa received over $205 billion in on-chain cryptocurrency value between July 2024 and June 2025—a 52% year-over-year increase. This positions the region as the third-fastest-growing crypto economy globally, behind only Asia-Pacific and Latin America.Key drivers include:

- Remittances: Cheaper, faster cross-border transfers bypassing expensive traditional channels.

- Inflation hedging: In countries facing currency devaluation, Bitcoin and stablecoins serve as reliable stores of value.

- P2P and retail activity: A higher share of small transfers (8% under $10K vs. global 6%) reflects grassroots, everyday use—Nigeria alone accounted for $92 billion, with Bitcoin dominating fiat on-ramps.

South Africa contributes significantly here, blending institutional clarity, merchant infrastructure, and community momentum. Events like Adopting Bitcoin Cape Town 2026 (held January 2026) highlighted these real-world use cases, from Lightning bootcamps to building resilient parallel economies amid infrastructure gaps.

Why This Matters for Africa's Future

As fiat systems face ongoing pressures, high remittance fees, capital controls, and inflation in multiple nations, Bitcoin’s borderless, censorship-resistant nature shines.

South Africa’s model shows how Lightning Network adoption can bridge the gap: turning global sound money into local utility without forcing merchants to hold volatile assets. With adoption accelerating (from grassroots circular economies to national-scale integrations), the continent is proving that Bitcoin solves real problems for real people.